Energy & Building

Kuwait Energy Outlook

Kuwait is one of the world’s top ten oil producers and holds the sixth largest proven oil reserves in the world. With its relatively small population, Kuwait has a very prosperous economy, but it is heavily dependent on oil- export revenues. The oil sector accounts for about 90% of export revenues, and net oil-export revenues are approximately 40% of GDP. Kuwait, like all oil-producing countries, is facing a changing energy world today. Shifting supply, demand and technology trends have ushered in an energy world where oil-price volatility and market uncertainty are the defining features. To ensure economic development and social prosperity in the years to come, Kuwait will require a new energy strategy, combined with a plan to foster economic diversification and reduce fossil fuel dependency.

Now is a particularly good time for an evaluation of Kuwait’s current energy situation and how energy demand and supply might, and could, evolve over the next two decades. With valuable support from the General Secretariat of the Supreme Council for Planning and Development, Kuwait is releasing its first ever economy-wide, in-depth energy analysis and predictions. In the Business-as-Usual case presented here, only current policies and plans are considered to have an impact on the projections. Under these assumptions, per capita greenhouse-gas emissions and energy demand per capita remain among the highest in the world, and carbon intensity of the economy is still persistently high. Viable options for public transport considerably lag behind other countries, and growth in renewable energy remains stymied by institutional and regulatory challenges.

Highlights

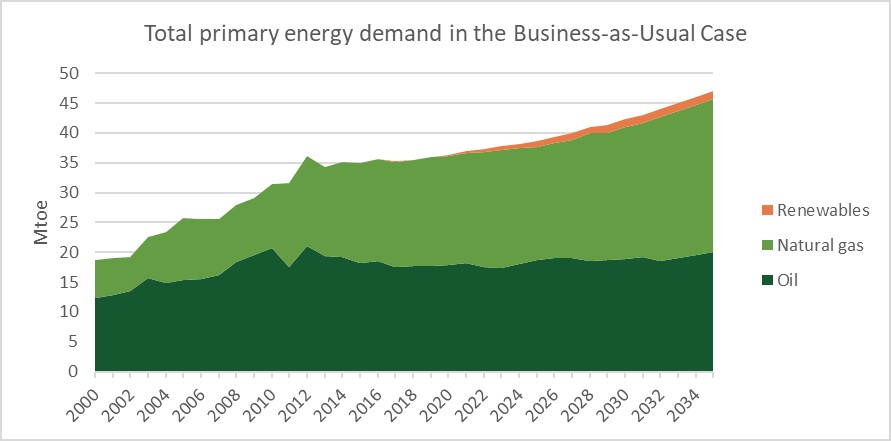

- In the Business-as-Usual Case, the share of oil in total primary energy demand steadily declines to 42% in 2035, a result of the government’s push to switch from oil to natural gas for power generation. Natural gas demand grows at a fast clip, by 2.2% per year in 2015-2035, and the share of gas in total energy demand climbs to 55% in 2035. Despite some progress in supporting solar generation, in the Business-as-Usual Case, the share of renewables in total primary energy demand remains low in 2035, only 3%.

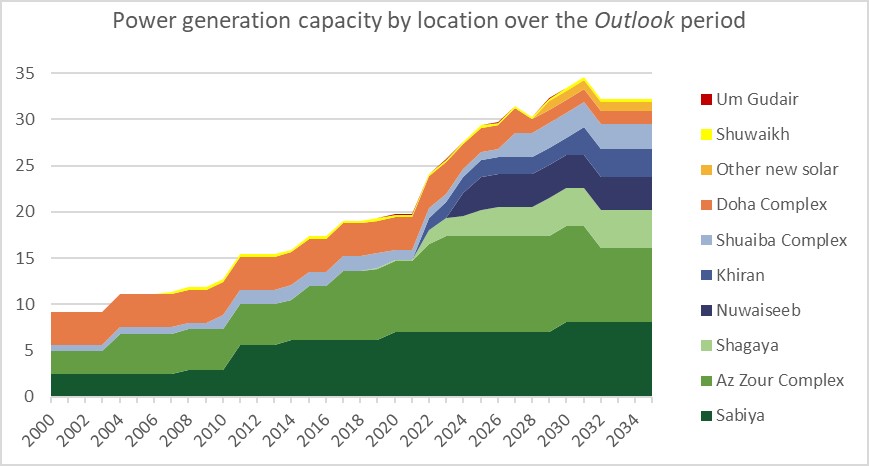

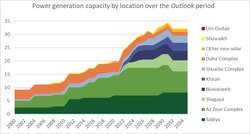

- Electricity generation capacity in Kuwait increases by over 13.2 gigawatts (GW) over the Outlook period, reaching 32 GW in 2035, a 70% increase over capacity in 2018. Combined-cycle plants make up the lion’s share of capacity expansions over the projection period, resulting in a more efficient and flexible fleet of power plants compared to today. These plants will use both oil and gas for generation, but Kuwait will favor the use of natural gas in combined-cycle and steam plants, and the share of oil products in total generation is likely to fall to about a quarter by 2035. Renewable-energy capacity, mostly solar, will make up 16% of total generation capacity.

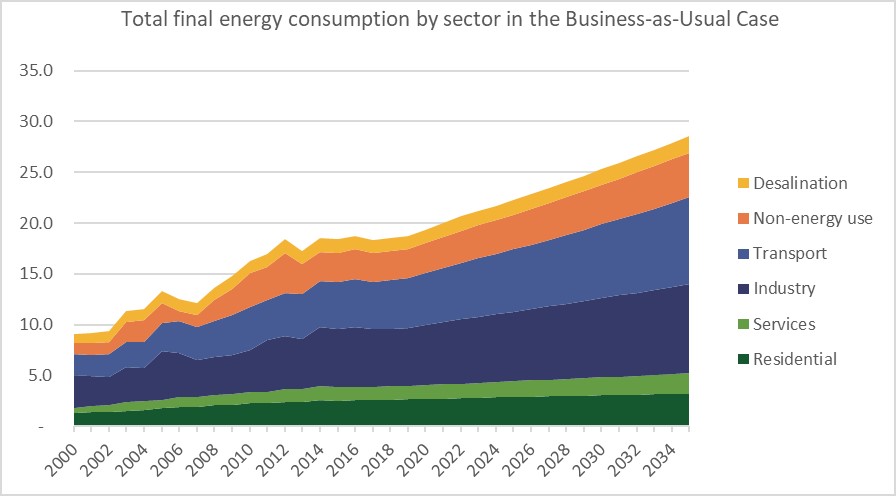

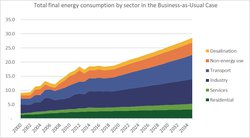

- The industry sector will still account for the largest share of final energy consumption in 2035, some 31%. In the Business-as-Usual Case, demand for oil in the transport sector grows by 3% per year on average, much faster than growth in the rest of the world. The transport share in total final energy consumption will be 30% in 2035. Growth in residential electricity demand is considerably slower over the Outlook period than in 2000-2015. Stricter enforcement of regulations and codes in the buildings sector play a major role in this deceleration. However, due to the absence of efforts to check rapid growth in oil demand in the transport sector, per capita energy demand in Kuwait continues to rise over the projection period, reaching 9.2 tonnes of oil equivalent per capita in 2035.

- Greenhouse-gas emissions increase from 83 million tonnes of CO2-equvialent in 2015 to 103.4 Mt of CO2-eq in 2035, at an average annual growth rate of 1.1%. Fuel-switching from oil products to natural gas in the power generation and industry sectors results in a 35% increase in emissions from natural gas, from 38.9 Mt of CO2-eq in 2015 to 60.1 Mt of CO2-eq in 2035. But oil-product emissions decline only slightly in 2015-2035, due to rapidly growing demand for oil products in the transport sector.

-

-

Scope of Work

Delivery Partner

-

-

Schedule

2019-2022